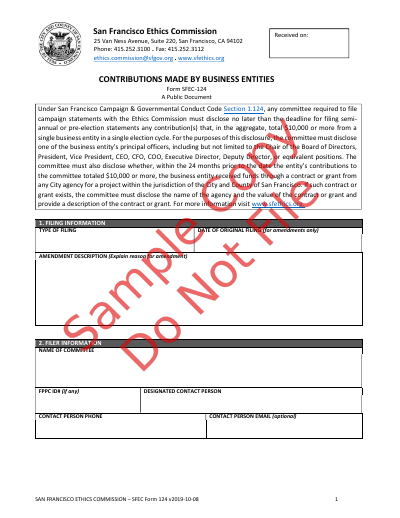

On January 1, 2019, local laws went into effect that established new disclosure requirements for committees. Under San Francisco Campaign & Governmental Conduct Code Section 1.124, any committee required to file campaign statements with the Ethics Commission must disclose certain additional information about any contribution(s) that, in the aggregate, total $10,000 or more from a single business entity in a single election cycle.

For the purposes of this disclosure, the committee must disclose one of the business entity’s principal officers. The committee must also disclose whether, within the 24 months prior to the date the entity’s contributions to the committee totaled $10,000 or more, the business entity received funds through a contract or grant from any City agency for a project within the jurisdiction of the City and County of San Francisco. If such contract or grant exists, the committee must disclose the name of the agency who provided the funding for the contract or grant, the value of the contract or grant, and a brief description of the scope of the contract. (Please note: The form has been modified and no longer requires the contract/grant number).

Business Entity

“Business entity” shall mean a limited liability company (LLC), corporation, limited partnership, or limited liability partnership. (Note: The business entity’s full legal name should be listed on Form SFEC-124. Example: If ‘John Bonson, LLC, Operations Division’ is the legal name of the business entity, a form with only ‘John Bronson’ listed will be deemed incomplete).

Principal Officers

For the purposes of this filing, “principal officers” include but not limited to the Chair of the Board of Directors, President, Vice President, CEO, CFO, COO, Executive Director, Deputy Director, or equivalent positions.

Election Cycle

For purposes of filing, “election cycle” shall mean: (1) if the committee receiving the contributions is a primarily formed committee, the period of time during which the committee is designated on its statement of organization to support or oppose a candidate or measure; or (2) if the committee receiving contributions is a general purpose committee, the period of time beginning January 1 of the year immediately following one election and ending on December 31st of the year during which the next election occurs.

Filings by Committees

When to file

The committee must file SFEC-124 no later than the deadline to file the semi-annual or pre-election campaign statement that must report the contribution that makes the cumulative total $10,000 or more. If a committee has filed a Form SFEC-124 after receiving $10,000 or more in contributions from a single business entity during a single election cycle and, during the same election cycle, receives an additional contribution from the same business entity, the committee is not required to file an additional Form SFEC-124 for any additional contribution(s).

How to File

To file SFEC-124, you must use the electronic link located at the bottom of this webpage. If you run out of space and are unable to include all of the information that you are required to disclose and the option, you must make a supplemental filing that includes the remaining information. Be sure to include the same identifying information on the supplemental filing as in the original to allow the Ethics Commission to connect the information.