When and Where are Reports Due

A developer must use the SFEC Form 3500 to file a total of five reports with the Ethics Commission with respect to each major project. The first (or initial) report must be filed within 30 days of the date the Planning Commission or any other local lead agency certifies the EIR for that project or, for a major project relying on a program EIR, within 30 days of the date that the Planning Department, Planning Commission, or any other local lead agency adopts a final environmental determination under CEQA.1

The developer must also use this form to file four subsequent quarterly reports, beginning with the quarter in which in the initial report is filed. The due dates for the quarterly reports are:

| Due Date | Period Covered |

|---|---|

| April 15 | January 1 through March 31 |

| July 15 | April 1 through June 30 |

| October 15 | July 1 through September 30 |

| January 15 | October 1 through December 31 |

Disclosure Report and Fee

The Disclosure Report for Developers of Major City Projects (SFEC Form 3500) must be filed electronically through the City and County of San Francisco’s DocuSign system by starting the form using the section below. The DocuSign e-filing process consists of two key steps – completing the form and signing the form – which may involve two participants. An authorized administrative staff or representative can initiate and complete the form electronically, and route it to the major developer for his/her signature through DocuSign. After the form is completed and submitted in the first step, an email will be automatically sent to the major developer with instructions for his/her signature. The major developer can then electronically sign the form in DocuSign by following the instructions in the email. The major developer may also complete and sign the form without the assistance of a staff member or representative by entering his/her information in the form as the person completing and signing the form.

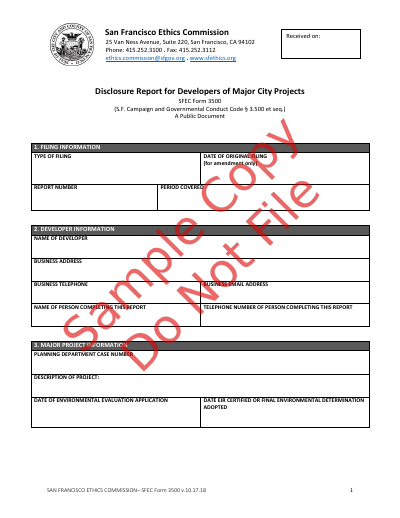

Click the image below to preview a form illustrating the information required to be disclosed. (Please note that this form is for viewing purposes only and that the electronic link shown below must be used to file the required information.)

Supplemental Sheet Templates

If there is not sufficient space in the DocuSign disclosure form to report the complete list of donations to nonprofit organizations and affiliates donating to nonprofit organizations, use one of the templates below to attach additional data to the filing. On SFEC 3500, check the box to add additional supplemental sheets and upload the supplemental list template below. You may use the template in Excel or PDF format.

- SFEC 3500-AS4 – Donations to Nonprofit Organizations Supplemental Attachment (PDF Format)

- SFEC 3500-AS4 – Donations to Nonprofit Organizations Supplemental Attachment (Excel Format)

- SFEC 3500-AS5 – Affiliates Donating to Nonprofit Organizations Supplemental Attachment (PDF Format)

- SFEC 3500-AS5 – Affiliates Donating to Nonprofit Organizations Supplemental Attachment (Excel Format)

Fee Payment

At the time of the first report the developer must pay a $500.00 fee. Fees may be paid on-line via credit card, debit card, or e-check via the City and County of San Francisco Payment Portal. You may also write a check payable to the City and County of San Francisco, C/O San Francisco Ethics Commission 25 Van Ness Ave. Suite 220 San Francisco, CA 94102.

What Must be Reported

Describing the Type of Report and Period Covered

Check the boxes on the report to indicate the type of report that is being filed and that applicable period covered. Note that the first report will always cover the period from one year prior to the filing of the EEA to the present. The reporting period for subsequent reports will depend on the quarter covered.

Describing the Developer and the Major Project (Parts 2 & 3)

In Part 2, you must enter the developer’s name, business address, business e-mail address, and business telephone number. In Part 3, you must enter the Planning Department case number and a description of the major project, as well as the date the EIR was certified or (if relying on a plan EIR) the date the final environmental determination was adopted.

What Nonprofit Donations Must be Reported (Part 4)

You must enter the name, business address, business e-mail address, business telephone number, and website address of any nonprofit organization (including charities, social welfare organizations, trade associations, etc.):

- To which the developer and/or its “affiliates” (see Part 5) have made donations during the reporting period which, when considered with all other donations to the nonprofit since one year prior to the filing of the major project’s EEA, cumulatively total $5,000 or more; and

- Which has had one or more contacts with an officer of the City and County, or has provided public comment at any hearing before any board or commission of the City and County, in order to influence the City officer with regard to the developer’s major project.

You must also enter the amounts and dates of the donations. Please note that you must also check where indicated in Part III if any donations were disclosed on any prior report you filed with respect to the same major project.

What “Affiliates” of the Developer Must be Reported (Part 5)

You must enter the name, business address, business e-mail address and business telephone number of any affiliate making donations reported in Section 4. An “affiliate” is any individual or entity that directly or indirectly controls, is controlled by or is under common control with, the developer. In this regard, the term “control” means the power to direct the affairs or management of another entity, whether by contract, operation of law or otherwise.

1 A final environmental determination includes: the issuance of a Community Plan Exemption (CPE); certification of a CPE/EIR; adoption of a CPE/Final Mitigated Negative Declaration; or a project approval by the Planning Commission that adopts CEQA Findings. In instances where more than one of the preceding determinations occur, the filing requirement shall be triggered by the earliest such determination.