- Overview of Ethics Commission’s Ethics Review Project.

- Legal and Factual Background on Gifts to/through Departments.

- Findings & Recommendations regarding Gifts to Departments.

- Findings and Recommendations.

- When depts distribute gifts provided by a restricted source to city officials that confer a personal benefit on those officials, this practice undermines the restricted source rule and must be more clearly prohibited.

- Existing disclosure requirements for gifts to City departments are ineffective. A single, standardized disclosure requirement should be administered by the Ethics Commission that provides more effective transparency into gifts to City departments.

- Summary of Recommendations.

- Findings and Recommendations.

- Recommended Process and Next Steps.

I. Overview of Ethics Commission’s Ethics Review Project

A. Background

The City’s ethics laws were created to “assure that the governmental processes of the City and County promote fairness and equity for all residents and to maintain public trust in governmental institutions.”[1] In light of the recent corruption allegations brought by federal and local agencies against City officials and contractors, the Ethics Commission undertook a comprehensive project to review existing ethics laws as its top policy priority. The purpose of the project is to assess whether current law adequately identifies and prohibits conduct that could give rise to a conflict of interest or otherwise undermine fair and objective government decision making. Where current laws and programs are insufficient, the project seeks to recommend and implement improvements.

The project is principally focused on analyzing unethical conduct revealed through the multiple ongoing corruption investigations and identifying policy approaches to prevent similar conduct in the future. It is important to note that no shortcoming identified in the law in any way excuses prior acts of public corruption. Rather, this review seeks to strengthen existing laws to foreclose problematic conduct that might otherwise be lawful and to better deter and detect future corrupt acts.

B. Project Methodology

The Ethics Commission’s Government Ethics and Conflict of Interest Review Policy Project is proceeding in multiple phases. The first phase of the project addressed behested payments and resulted in the Commission recommending legislation that would prohibit most City officers and high-level employees from soliciting behested payments from individuals who have a matter before the officer or employee’s department. Currently, the legislation is pending before the Board of Supervisors.[2]

The current phase of the project focuses on gift laws. At the Commission’s August 13, 2021 meeting, Staff presented Report on Gifts Part A: Gifts to Individuals, which analyzed gifts made directly to individual City officials. The current report presents findings regarding gifts made through City departments that confer personal benefits on City officials. (This report uses the term official to refer both to City officers, such as elected officials and commissioners, and City employees). Subsequent phases of the project are planned to address other aspects of government ethics law.

The methodology used during all phases of the project includes reviewing the findings of the ongoing corruption investigations, analyzing existing City laws and programs, performing empirical research using available data sources, and comparing approaches taken in other jurisdictions. Another core element is engagement with stakeholders, including advocates, good government groups, members of the regulated community, and peer agencies. Staff held interested persons meetings on October 13 and 15, 2020, and on April 27 and 29, 2021 and will continue to hold such meetings periodically throughout the course of the project.

C. Goals

Because of the ability of a gift to unduly influence or appear to unduly influence the actions of a City official, gifts pose a danger to the integrity of City government and the public’s trust. It is critical that the laws governing gifts be as effective as possible at limiting undue influence and preserving the public’s trust. This includes rules governing gifts that are given to City departments, especially those that confer a personal benefit to a City official. When a gift made through a City department confers a personal benefit on individuals within the department, it creates a danger of undue influence akin to gifts made directly to the individuals.

To address the corruption risks associated with gifts to City departments, this report reviews state and local laws governing the receipt of gifts by City departments and the distribution of gifts by departments to City officials. Staff sought to identify loopholes and oversights in the local laws that cause them to be unnecessarily narrow, permissive, or complex. Such shortcomings impede the overall effectiveness of gift laws and, over time, can lead to an organizational culture that does not attach the highest value to compliance with gift rules.

Instead, gift rules should be robust and clear so as to effectively address ethical risks and to plainly communicate to officials, employees, and the public that certain kinds of gifts are strictly off limits. Such strong, simple gift rules are more likely to prevent ethical issues and, where they are not followed, more likely to generate whistleblower or other complaints and result in penalties. This approach to gift rules will help ensure that a culture of casual corruption does not exist around gifts.

II. Legal and Factual Background on Gifts to/through Departments

This section first provides a summary of existing laws that govern gifts to City departments. This includes laws affecting gifts given to City departments for carrying out City functions and gifts made through a City department that bestow personal benefits on department officials. The section then presents Staff’s empirical research into current City practices regarding gifts to departments.

A. Existing Laws on Gifts to Departments

1. Definition of Gift to a City Department

No single definition exists in state or local law that defines what constitutes a gift to a City department; various provisions of state and local law define such payments in different ways. For purposes of this report, a gift to City department is any payment to a City department from a non-City entity or individual, excluding other government agencies, for which the City department does not provide equal or greater consideration. This definition excludes grants that the City may receive from state or federal government agencies. It also excludes most payments that are made as part of a contract between the City and a non-City entity, assuming that the City provides equal consideration for the payment. This definition encompasses each of the definitions that exist in state and local law.

2. Treatment of Gifts to City Departments under State Law

State law generally splits gifts to government agencies into two groups: ones that are used in a manner that bestows a personal benefit on at least one official, and ones that do not bestow personal benefits. The reason for this distinction is that state law has historically focused on gifts to individuals. A gift to an individual is a payment that bestows a personal benefit on the individual where equal or greater consideration is not provided by the recipient. In situations where an official receives a personal benefit from a gift to their agency, state law regulates this as a potential gift to that individual. The California Fair Political Practices Commission (FPPC) does not directly define the term personal benefit, but the agency interprets it broadly to encompass situations in which an official receives something of value.[3]

When a gift to a government agency is not used in a way that bestows a personal benefit on any official, state law does not regulate the gift because there is no potential that the gift to the agency is also a gift to an individual within the agency.[4] These are gifts that are used for programmatic purposes to perform the functions of the department. For example, a department may receive a free photocopy machine to be used in the office for departmental business. No official receives a personal benefit from the photocopy machine. This gift would not be regulated under state law. The same would be true for other types of equipment, supplies, or software that an agency might accept in order to carry out its ordinary functions.[5] These are truly gifts to a government agency since they merely support the agency’s operations.

On the other hand, state law does regulate gifts through government agencies when an official receives a personal benefit from the gift. As discussed above, such a gift could constitute a gift to that official, which would trigger the state gift limit and disclosure requirement (as well as San Francisco’s restricted source rule). These gifts are more accurately described as gifts through a City department, since the department typically acts as a mere pass through and provides the personal benefits to City officials.

Even when a gift made through a City department bestows a personal benefit on an official, state law provides two ways in which such personal benefits can be exempted from the gift limit and disclosure: (1) free tickets and passes distributed under a valid ticket policy, and (2) payments that are used for official agency business, including official agency travel.

Tickets and Passes

First, state law allows an official to receive a free ticket or pass through the official’s agency without being subject to the state gift limit and disclosure requirement. The ticket must be distributed to the individual pursuant to a ticket policy adopted by the agency that meets certain requirements contained in state law.[6] One of the requirements is that the ticket must be given to the individual to serve a “public purpose.” But, state law fails to define public purpose and instead allows the local agency to determine what constitutes a public purpose. The agency must disclose the distribution of tickets on the FPPC Form 802, which must be posted on the agency’s website. The Form 802 must state the source of the tickets, the public purpose that the tickets serve, and, if any recipient is an elected or appointed officer, the name of each officer who receives a ticket. Officers and employees do not need to disclose the tickets on the FPPC Form 700 (Statement of Economic Interests) because the tickets are not considered to be gifts to them as individuals if the distribution meets the requirements just described. However, officials are free to treat tickets received from a department as gifts and report them on the Form 700 (for example if the department does not have a ticket policy in place). But, this means the tickets would be subject to gift rules, including the state’s $520 annual limit and the restricted source rule.

Eight City departments have adopted ticket policies. Those departments are Recreation and Parks, Port, Arts Commission, Film Commission, War Memorial Board of Trustees, Asian Art Museum, Fine Arts Museums, and the Treasure Island Development Authority (TIDA).[7]

Payments Used for Official Agency Business

The second state law exception that allows an official to accept a personal benefit given through a government agency without being subject to gift rules is for certain payments used for official agency business. These payments fall into two categories: those related to travel,[8] and those not related to travel.[9] For payments to qualify for the travel exception, the travel must be for the purpose of conducting inspections and audits, attending trainings and conferences (if the travel is paid for by the organization holding the training or conference), attending working group meetings, and performing certain site visits.[10] For payments that are not related to travel, state law does not explicitly state what constitutes official agency business.

In order for either of the official agency business exceptions to apply, the agency must report the payment in question on the FPPC Form 801, which must be posted on the agency’s website.[11] If the Form 801 is properly posted, the official benefiting from the payment does not need to report the payment on the Form 700 because it is not considered a gift under state law.[12] In order for either exception to apply to a payment, the agency, not the source of the gift, must select which officials or employees will personally benefit from the payment.[13]

3. Treatment of Gifts to Departments under San Francisco Law

As discussed, state law only regulates gifts to departments where a personal benefit accrues to at least one official. San Francisco law, on the other hand, affects all gifts to departments regardless of whether any personal benefit to an official is involved. The local laws that apply are: (a) disclosure pursuant to the Sunshine Ordinance, (b) annual disclosure to the Board of Supervisors, (c) approval by the Board of Supervisors of gifts over $10,000, and (d) disclosure to the Controller’s office.

Sunshine Ordinance Disclosure

The Sunshine Ordinance requires that anytime a department accepts a payment “for the purpose of carrying out or assisting any City function,” the amount and source of the payment must be disclosed on the department’s website.[14] The Ordinance does not specify where, by when, in what format, or for how long the disclosure must appear on the department’s website.

The Ordinance also requires that when an entity provides such a payment to a department, the “entity must agree in writing to abide by” the Sunshine Ordinance. The City Attorney’s office has issued guidance that this language means that the entity must agree to comply with the gift disclosure rule and post a list of its donors on the entity’s website.[15] However, the City Attorney’s office has not issued general guidance as to whether this requirement must be applied broadly to any non-City entity that makes a single payment to a City department, or whether it only applies to entities that regularly make such payments, such as “friends” groups.

Annual Gifts Report to the Board of Supervisors

The Administrative Code also requires that “[e]ach department, board, and commission accepting gifts … shall furnish to the Board of Supervisors annually within the first two weeks of July a report showing such gifts received, the nature or amount of said gifts, and the disposition thereof.”[16] These disclosures, when made, are delivered to the Clerk of the Board of Supervisors. Again, no required format, contents, or posting of the disclosures is specified by the Code.

Board of Supervisors Approval: Accept and Expend

Anytime a City department wishes to accept any gift valued at over $10,000, approval by the Board of Supervisors is required.[17] This process of obtaining Board approval is known as accept and expend. The Government Audit and Oversight Committee of the Board of Supervisors considers departmental requests to accept and expend gifts and can refer requests to the full Board with a positive recommendation. Board approval can be given retroactively to gifts that have already been accepted and used by departments.

The only exception to the Board approval requirement is if a gift is accepted under the terms of a statutory gift fund. Gift funds, of which there are at least two hundred listed in the Administrative Code, are established by the Board and permit a particular department to accept private gifts for particular purposes without going through the accept-and-expend process.[18] Gifts accepted under the terms of a gift fund are still subject to all other rules regarding gifts to departments.

Disclosure to the Controller’s Office

The Administrative Code requires that anytime a department “accept[s] any gift of cash or goods which may from time to time be offered to the City and County of San Francisco through any department, board, or commission thereof, … [a]ll such gifts will be promptly reported to the Controller.”[19] The Administrative Code does not specify precisely when this disclosure must be made, what information must be disclosed, nor what the Controller’s office must do with the disclosed information.

Summary of Local Disclosure Requirements

Table 1 below provides a summary of the primary local laws that apply to gifts to City departments.

Table 1: Summary of San Francisco Laws regarding Gifts to City Departments

| 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|

| Website Disclosure | Donor Entity Funding | Annual Report to Board of Supervisors | Accept and Expend Approval | Controller Disclosure |

| SF Admin Code 67.29-6 | SF Admin Code 10.100-305 | |||

| Action: Gift must be disclosed as public record and posted to the department’s website. | Action: The entity providing the funds must agree in writing to abide by 67.29-6. | Action: Gift must be included in an annual report to the Board of Supervisors. | Action: Gift must be approved by the Board of Supervisors. | Action: Gift must be promptly disclosed to the Controller. |

Required When:

|

Required When:

|

Required When:

|

Required When:

|

Required When:

|

Restricted Source Rule

As discussed in Report on Gift Laws, Part A: Gifts to Individuals, the City’s restricted source rule is a cornerstone law regulating gifts to City officials. The rule prohibits officials from soliciting or accepting gifts from any restricted source. A source is a restricted for an official if the source (a) does business with the official’s department (i.e. is a party to a contract with the department), or (b) has attempted to influence the official’s actions during the last 12 months. The purposes of the restricted source rule include preventing people from seeking to unduly influence City officials by giving gifts, preventing officials from seeking gifts in a manner that creates a pay-to-play system, and avoiding the appearance of undue influence or pay-to-play in the eyes of the public.

B. Research on Gifts to Departments

This section presents information about current City practices regarding gifts to City departments. The first part of this section analyzes some of the gifts that departments have reported in the public disclosures outlined above that, given the City’s strong interests in avoiding pay-to-play issues, are problematic. Specifically, gifts are problematic when a City official personally benefits from a gift made through a City department by a person or entity that was likely a restricted source for the official.

The second part of this section reviews the public disclosures that are currently available on gifts received by City departments. It provides an analysis of how effective the disclosures are at providing transparency into gifts to the City.

1. Examples of Problematic Gifts Made through City Departments: Gifts Originate from Restricted Sources and Confer Personal Benefits on City Officials

The public disclosures for gifts to City departments reveal several instances of problematic gifts being made through departments. In these instances, things of value were provided to a department and used in a manner that bestowed a personal benefit on officials within that department; the problem is that the gifts were given by individuals or entities that would likely be considered restricted sources for the officials who benefitted from the gifts. When personal benefits provided through a City department originate from a restricted source, this serves to undermine the City’s restricted source rule and can create the appearance of a pay-to-play system within the City.

This same pattern of restricted source gifts being passed through a City department was observed on the part of Mohammed Nuru as alleged in the ongoing federal corruption investigation. This section first describes how Nuru allegedly used the Department of Public Works to pass restricted source gifts to department employees. It then presents Staff’s research showing that other departments have engaged in similar practices. This report does not discuss whether this conduct on the part of department officials violates existing ethics laws. Rather, the report identifies the conduct as problematic and in Section III recommends policy approaches to prevent similar conduct in the future.

Gifts through Departments Identified by Federal Investigation – Department of Public Works

As discussed in Report on Gift Laws, Part A: Gifts to Individuals, the Department of Justice is conducting an ongoing corruption investigation of various City departments, officials, employees, and contractors. To date, criminal charges have been brought against 13 individuals, 5 of whom were City officers or employees.[21] Many of the federal allegations relate to Mohammed Nuru, then the director of the Department of Public Works (DPW). The criminal complaints filed against two Recology executives allege that the executives arranged for payments to the Department of Public Works that ultimately conferred personal benefits on employees within the department, including Nuru. Because Recology contracts with the Department of Public Works, the company is a restricted source for all employees of the department and employees are therefore prohibited from accepting any gifts from Recology or company representatives.[22]

Holiday Parties Funded by Recology: The federal investigation describes how Recology gave Nuru $60,000 for DPW’s annual holiday parties between 2016 and 2019.[23] The company first passed the funds through various nonprofit organizations, allegedly to conceal their true source. The Department of Public Works (through Nuru) accepted this funding for its annual holiday party, which provided a personal benefit to all City officers and employees who attended. The events provided City officials with complimentary food, alcohol, and entertainment. Such personal benefits are considered gifts under current ethics laws.

As discussed, Recology is clearly a restricted source for DPW officials because of its contracts with the department and its attempts to influence the actions of department personnel, such as through the refuse rate adjustment process. Had Recology or the executives given food, drink, or entertainment directly to DPW personnel, this would have constituted a gift and would have violated the restricted source rule. The fact that these personal benefits passed through DPW first before being enjoyed by department employees does little to remove the danger of undue influence that the restricted source rule is designed to prevent. It also does little to prevent the appearance of pay-to-play or to maintain public trust in the operations of City government. If anything, the involvement of the department only served to institutionalize and lend the appearance of legitimacy to these practices.

Other Benefits from Recology: The federal complaints outline other benefits from Recology aside from the holiday parties that passed through DPW to City officials. Recology allegedly funneled approximately $1,000,000 through nonprofit organizations to DPW.[24] Nuru allegedly used these funds to provide his employees with “holiday events, big Public Works Week picnics, a health fair with acupuncture and massages, staff lunches, awards, Public Works gear, and even a treadmill for the DPW yard.”[25] The complaints also report these funds being used to pay for “deejay services, hats, t-shirts and other merchandise, Bay to Breakers entry fees for DPW employees, funeral-related expenses, and thousands of dollars to cover the costs of food and other vendors for DPW events….”[26]

As with the holiday parties, these payments originated from a restricted source and conferred personal benefits on City employees. The fact that the benefits were distributed by DPW does not mitigate the corrupting influence that gifts from a restricted source carry. There is still an unacceptable risk that City employees will be influenced by the gifts when carrying out their City duties and that the public would perceive the gifts as a way for Recology to improperly seek preferential treatment from the department.

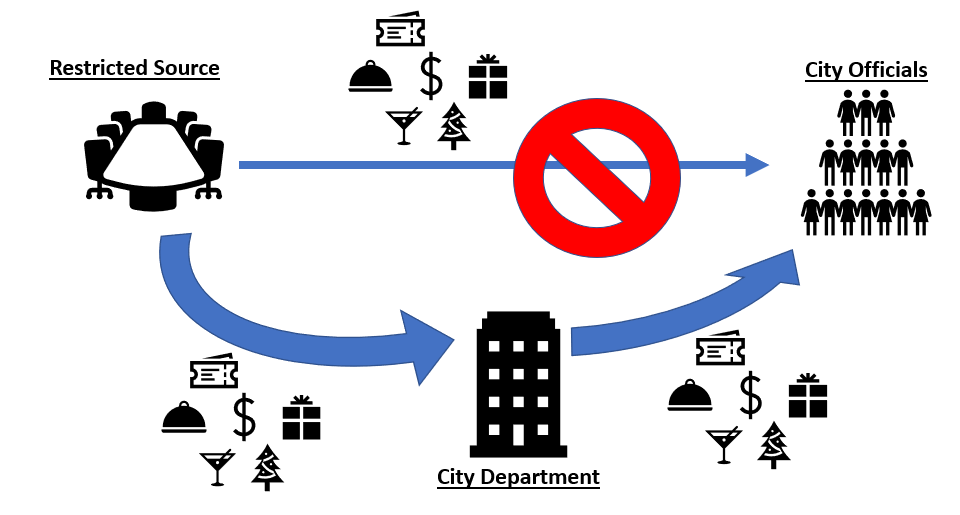

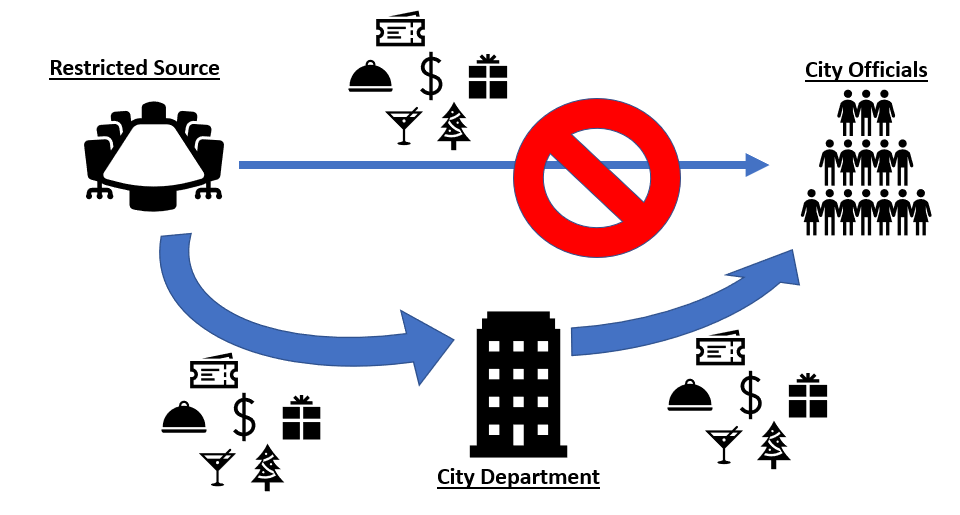

Figure 1 below depicts gifts being given by a restricted source through a City department. Individual officials within the department are prohibited from accepting gifts from the restricted source, yet the department nonetheless receives the gifts and distributes them to the individual officers and employees.

Figure 1: Restricted Source Gifts Passing through a City Department

This practice by DPW clearly undermines the restricted source rule by passing benefits to City officials through their department from sources that would be prohibited if the gifts were given directly to the individual officials. Unfortunately, this is a practice that is not limited to the Department of Public Works.

Gifts through Departments Identified by Staff Research – Parties and Event Tickets

Staff reviewed the departmental gift disclosures discussed in section 2.B.1 above and found several examples of gifts to City departments that conferred a personal benefit on City officials. In several of these instances the benefits were provided by a source that would likely be a restricted source for the officers and employees who received the benefits. This practice mirrors the problematic conduct within DPW discussed above and runs contrary to the purposes of the restricted source rule—preventing undue influence, pay-to-play, and the appearance thereof.

Examples of Parties Funded by Likely Restricted Sources

Planning Commission/Department – Staff Retirement Celebration Funded by Likely Restricted Sources: On June 28, 2019, a party was held for a retiring Planning Department employee. According to Planning Department staff, this party was attended by roughly 220 individuals, including roughly 100 City officials and roughly 120 people from outside City government.[27] Both Planning Department staff and Planning Commissioners attended. Food and alcohol were provided at the event, which Planning staff estimated to cost in total between $17,500 and $21,000.[28]

Some of the funding details of this event were disclosed on the Planning Commission’s website as a gift to the department.[29] According to Planning Department staff, all attendees of the event, including City officers and employees, were asked to purchase tickets. However, tickets were sold to City officials at a deep discount: tickets for non-City attendees cost $125 per person, while tickets for City officials cost $25. Non-City attendees were explicitly informed that a portion of their ticket price would subsidize the cost of attendance for City officials and that this portion would be publicly disclosed by the Planning Department pursuant to the Sunshine Ordinance. Based on this ticket price arrangement, the non-City attendees contributed at least $15,000 in total, likely covering at least 85% of the event’s costs, while comprising only 55% of the event’s attendees. According to Planning Department staff, a relative of the retiring employee coordinated the ticket sales and used the proceeds to provide the venue, catering, and drinks for the party.

The sources that the Planning Department reported as largely funding the party are companies that regularly seek project approvals from the Planning Commission and seek to influence the outcome of Planning Department processes. Some are large real estate development firms, and others are law firms that work on land use issues. These include real estate developers Tishman Speyer, One Vassar, and Associate Capital and law firms Rueben, Junius, & Rose, J. Abrams Law PC, and Gibson, Dunn, & Crutcher LLP. Other event supports included advocacy organizations Ground Floor Public Affairs and the Residential Builders Association.[30]

Rueben, Junius, & Rose was reported to be the largest funder of the party and is heavily involved in matters before the Planning Department. Fifteen individuals at the firm are registered lobbyists, meaning that they accept payment to contact City officials to urge particular legislative or administrative actions.[31] The firm reported 2,930 contacts with Planning officials in the 12 months before the Planning Department party.[32]

Andrew Junius is a partner at the firm and lobbied 31 different Planning officials a total of 126 times in the 12 months before the party. James Reuben, another partner, lobbied 18 different Planning officials a total of 193 times in the 12 months before the party. Tuija Catalano is another lobbyist with Reuben, Junius & Rose. In the year before the retirement party, Catalano had 47 lobbying contacts with 15 different Planning officials. All of Catalano’s contacts involved a project at 2300 Harrison Street. This property was discussed at the Planning Commission meeting on June 6, 2019 (three weeks before the party).[33] These reported attempts by Rueben, Junius, & Rose to influence the actions of Planning officials almost certainly make the firm a restricted source for the officials who were contacted.

Many individuals at Rueben, Junius, & Rose are also registered permit consultants—or permit expediters—meaning that they contact City employees to urge the approval of permits. In the year leading up to the party, seven individuals from the firm contacted 40 separate Planning Department employees a total of 102 times regarding permits.[34] These attempts to influence likely make the firm a restricted source for each Planning employee who was contacted.

Perhaps most strikingly, four lobbyists with Rueben, Junius, & Rose reported lobbying seven high level Planning Department employees on the day of the party.[35] It is not clear whether these communications took place at the party itself or earlier in the day. The Planning Department was unable to confirm which department officials attended the event, and Staff were unable to obtain details from Rueben, Junius, & Rose as to which lobbyists from the firm attended. But, the fact that four lobbyists from the firm lobbied Planning staff on the same day as the party underscores the closeness between the firm’s business with the Planning Department and its funding of a Planning Department event at which department officials who attended received a personal benefit.

Similarly, real estate developer Tishman Speyer was reported by the Planning Department as a major funder of the party. The firm regularly attempts to influence Planning officials on major real estate projects. For example, at the Planning Commission’s June 6, 2019 meeting (three weeks prior to the party), the Commission discussed and approved a Large Project Authorization for 598 Brannan Street, a Tishman Speyer Project.[36] In the 12 months prior to the party, Tishman Speyer had paid for lobbyists to contact 19 separate Planning Officials a total of 113 times regarding the project at 598 Brannan. These attempts to influence the actions of Planning officials likely make the company a restricted source for all who were contacted by the lobbyists. If any of these officials attended the party, the personal benefits they received run counter to the purposes of the restricted source rule.

Because of their dealings with Planning officials, each of the companies that helped fund the party was likely a restricted source for many of the department officers and employees who received discounted tickets to the party. These individual officials would clearly have been prohibited from accepting free food or drinks from these restricted sources had they accepted them directly. However, the department helped arrange a party at which the same basic outcome resulted. The involvement of the department in the party arrangement does little to mitigate the potential corrupting influence that gifts from a restricted source can have. This type of activity undermines the restricted source rule and creates a risk, and the appearance, that the officials may give preferential treatment to the entities because of gifts received.

Airport Commission – Airport Terminal and Grand Hyatt Opening Celebrations: In 2019, the Airport held three events celebrating the opening of the Harvey Milk Terminal 1 and the Grand Hyatt at SFO; a fourth event (a Gala dinner) was planned for 2020 but was cancelled due to the COVID-19 pandemic. Of the events that occurred, two of the three were private celebrations for people who worked on the terminal and hotel projects, along with their guests. The events were attended by City employees, Airport Commissioners, Arts Commissioners, and elected officials. These private, invitation-only events featured live entertainment, food, and cocktails.

To cover the cost of the four scheduled events, the Airport reported accepting $1,018,000 in gifts from non-City sources.[37] This includes $845,000 in cash gifts and $173,000 of in-kind gifts. Most of this funding came from entities that would likely be restricted sources for Airport officials because they do business with the Airport. Of the $1,018,000 given for the events, 86% came from Airport contractors or tenants. For example, Hensel Phelps Construction was the single largest donor funding the events, giving $99,000. Hensel Phelps was a party to a $1.1 billion construction contract with the Airport, which the Airport Commission had voted as recently as September 2018 to increase.[38] Because of this contract, Hensel Phelps was a restricted source for all officers and employees of the Airport. Likewise, Austin Webcor Joint Venture, the second largest supporter of the events at $75,000, was a party to a $768 million contract with the Airport.[39] Austin Webcor Joint venture was thus a restricted source for all Airport officials at the time of the parties.

The payments for these celebrations bestowed personal benefits on Airport officials in the form of free food, drinks, and entertainment. Nearly all of the reported funding for these gifts came from entities that do business with the Airport and would thus be restricted sources for Airport officials. An Airport official would clearly have violated the restricted source rule by accepting a free meal or other gift directly from one of these contractors. Yet, the department organized over $1 million in funding for events that accomplished the same result. It appears that the Port of San Francisco engaged in a similar practice when it hosted its 150th Anniversary Gala: many of the companies that funded the event appear to do business with the Port and would therefore be restricted sources for all Port officials.[40] This type of gift giving through a City department undermines the restricted source rule by creating a pathway—intended or not—for City officials to receive gifts that can create the appearance of pay-to-play and an opportunity for undue influence.

Entertainment Commission – Holiday Party Funded by Permittees: On December 3rd, 2019 the Entertainment Commission hosted a holiday party that was attended by City officials from Entertainment and other departments as well as non-City individuals.[41] According to the Entertainment Commission, roughly 200-250 people attended the event. Twenty-two of the attendees were City officials, and the majority of the non-City individuals were industry stakeholders. Four of the six sitting members of the Entertainment Commission attended the event.[42] According to Entertainment Commission disclosures, the party was largely funded by companies holding permits issued by the Entertainment Commission. The Entertainment Commission’s website discloses seven gifts associated with the Commission’s holiday party.[43] Of the seven gifts associated with the holiday party, four of the gift sources (representing $9,443 of the $10,979, or 86%, given for the event) were entities that had been issued entertainment permits, which are issued by the Entertainment Commission. The largest single funder of the party, Mezzanine SF, provided the venue for the event, valued at $7,500. The company was at that time the holder of an entertainment permit issued by the department in 2016. The application for this permit and communications pertaining to it would likely make the company a restricted source for many officials within the Entertainment Commission. (As recommended in the Report on Gifts Part A: Gifts to Individuals, the restricted source rule should be clarified such that permit applicants are considered to be doing business with the issuing department and are therefore a restricted source for all officers and employees within the permit issuing department, as is already the case for contractors.)

The relationship of Mezzanine SF and other donors to the department raises similar issues as in the case of DPW and its acceptance of money from Recology to fund holiday parties and other personal benefits for its employees. Such gifts would likely be considered restricted source gifts if given directly from the source to the officials in question. Distributing the gifts through a City department does little if anything in practice to reduce the risk that the gifts will result in undue influence over the department’s official actions. Such gifts made through departments can still create the appearance in the eyes of the public that the department receives special perks in exchange for favorable treatment, the essence of a pay-to-play system that the City’s restricted source rule was intended to prevent.

Office of the Mayor – Holiday Party Funding Not Publicly Disclosed

As part of its Sunshine Ordinance disclosures, the Office of the Mayor reported receiving $3,800 in funding for a staff holiday party in December of 2019. Staff learned from the Mayor’s office that the party was held at the Emporium SF, an arcade bar in San Francisco. Roughly 80-100 people attended, the majority of whom were City officers or employees, including the Mayor. Attendees were provided with free food and drinks.

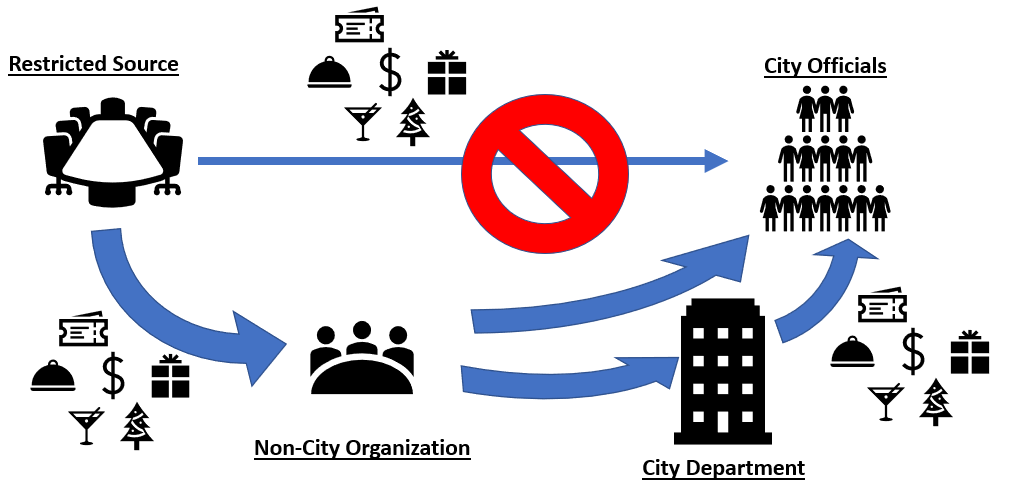

According to the Mayor’s website disclosures, the funding for the party was provided by the “San Francisco Special Events Committee,” which according to the Mayor’s staff is a 501(c)(3) organization that funds special events involving the City and County of San Francisco. Mayor’s office staff were initially unable to provide further information about where the San Francisco Special Events Committee obtained the funds it used to pay for the party. Information about the organization that is readily available online is limited to what is provided on the organization’s tax documents and includes the group’s name, mission, and principal officer.[44] It does not appear that the organization has publicly disclosed its funding sources, as is required by the Sunshine Ordinance for entities that provide funding to City departments.[45] The principal officer of the organization is Charlotte Maillard Shultz, who is the Chief of Protocol within the Mayor’s Office of Protocol and a member of the War Memorial Board of Trustees. In a September 23, 2021 letter, Ms. Shultz explained to the Mayor’s office that the funding had been provided by a member of the War Memorial Board of Trustees.

The lack of public transparency into the ultimate source of funding for this event is problematic. Since the event provided free personal benefits to City officials, it is vital to know who paid for it. Without public disclosure, it is possible that such an event could be funded by restricted sources and that this fact would not come to light. This arrangement is similar to the DPW holiday parties in that a non-City organization funded a free holiday party for City officials using money collected from undisclosed private sources. In the case of DPW, the Department of Justice found that the use of the nonprofit intermediaries constituted a deliberate attempt to conceal the true source of the funds (which was Recology) and charged multiple individuals with money laundering. In the case of the Mayor’s holiday party and the nonprofit that paid for it, neither the Mayor’s Office website nor the nonprofit disclosed to the public who the source of the funding was or why the source was not identified.

Free Event Tickets Provided by Restricted Sources

Recreation and Parks Department – Free Outside Lands Music Festival Tickets: As discussed above, Form 802 filings are posted by departments to disclose free tickets and passes provided by a department to City officials. Of the roughly $1.2 million of tickets distributed by City departments since 2009, about half of the total value ($643,569) was distributed by the Recreation and Parks Department (Rec and Park). These tickets consist mostly of tickets to the annual Outside Lands music festival in Golden Gate Park. The festival is organized by event promoter Another Planet Entertainment. Rec and Park has reported distributing 1,855 Outside Lands tickets valued at a total of $430,950, between 2015 and 2019.[46]

The majority of the Outside Lands tickets distributed by Rec and Park have gone to Rec and Park employees and officers, as seen below in Table 2. Of the 1,855 tickets to Outside Lands Rec and Park reported distributing between 2015 and 2019, 1,442 (78%) were reported as going to City officials, with 1,202 (65%) going to officials within Rec and Park.[47] The department’s ticket distribution disclosures indicate that individuals were often given multiple tickets, presumably for use by their guests. For example, Rec and Park disclosed giving Rec and Park Commissioners free tickets to Outside Lands in both 2017 and 2019. In 2017, six commissioners received a total of 12 tickets worth a combined value of $9,540 and in 2019, two commissioners received a total of four tickets worth a combined value of $3,140.

Table 2: Outside Lands Tickets Reported as Distributed by Rec and Park by Recipient (2015-2019)

| Year | Total # of Tickets Distributed | $ Value of Tickets Distributed | # of Tickets to City Officials | $ Value of Tickets to City Officials | # of Tickets to Rec & Park | $ Value of Tickets to Rec & Park |

|---|---|---|---|---|---|---|

| 2015 | 348 | $68,420 | 296 | $56,920 | 224 | $37,920 |

| 2016 | 346 | $76,090 | 268 | $55,420 | 216 | $39,600 |

| 2017 | 354 | $86,829 | 284 | $65,689 | 238 | $49,779 |

| 2018 | 409 | $100,141 | 320 | $74,140 | 296 | $65,860 |

| 2019 | 398 | $99,470 | 274 | $62,850 | 228 | $49,060 |

| Total | 1,855 | $430,950 | 1,442 | $315,019 | 1,202 | $242,219 |

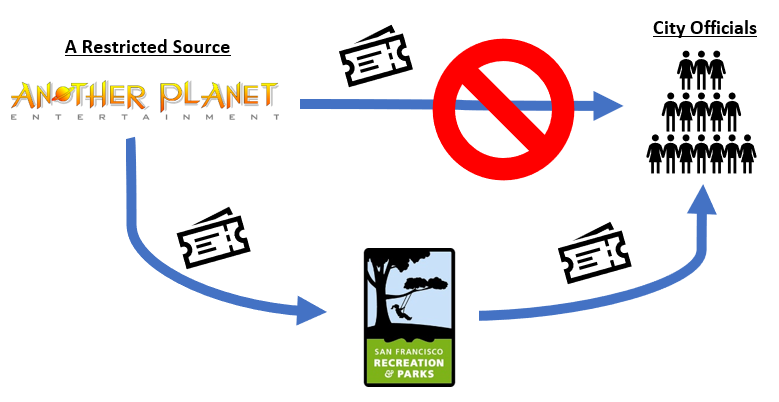

This practice is problematic because the tickets are donated by Another Planet Entertainment, which is a restricted source for officials within Rec and Park. This is because Rec and Park, as the department that administers Golden Gate Park, is responsible for permitting the Outside Lands festival. The department and Another Planet entered into a Festival Use Permit agreement in 2009, which was extended in 2012 and again in 2019.[48] The existence of this agreement means that Another Planet does business with Rec and Park and is therefore a restricted source for all department officials.[49] Department officials would clearly be prohibited from accepting free tickets provided to them directly by Another Planet. Yet, Rec and Park nonetheless regularly distributes tickets provided for free by Another Planet to its employees and officers, effectively resulting in the same outcome. This practice is illustrated in Figure 2.

Figure 2: Flow of Tickets from Another Planet to City Officials

The donation of festival tickets by Another Planet to Rec and Park is not an isolated or random occurrence. Rather, it is set forth in the festival permit agreement itself. The permit requires Another Planet to “donate to [the] City, at no charge to [the] City, a reasonable and customary number of general admission passes for each day of the Festival.”[50] Rec and Park staff stated that the donation of free festival tickets to the department is not part of the fee charged for the permit. Regarding this provision of the permit agreement, Rec and Park staff stated that “it is standard practice to provide tickets to landlords.” Importantly, event tickets are not necessary in order for City employees to access the Outside Lands festival site in order to perform safety inspections and other official tasks. The festival permit requires that such administrative access be provided to City officials, and Rec and Park staff and Another Planet both confirmed that this access does not require a festival ticket.[51] City credentials are sufficient to access the festival site for administrative purposes.[52] Rather, the free tickets are distributed solely to allow the recipient to attend as a festivalgoer.[53] Also, the permit agreement only requires that general admission passes be provided to Rec and Park. But, the department’s disclosures indicate that a large number of VIP passes, which are roughly twice as expensive and include many exclusive benefits aside from festival admission, are routinely provided through the department to City officials.

It also appears that Rec and Park has failed in several instances to disclose the tickets they have distributed to City officials on the Form 802. The permit agreement with Another Planet has stated since its creation in 2009 that the company would provide a “reasonable and customary number of general admission passes” to Rec and Park. Ethics staff confirmed with Another Planet that the company has provided the department with free tickets to each festival since that time. However, the department only had Form 802s for 2015, 2016, 2018, and 2019 posted on its website when reviewed by Staff. No ticket distribution disclosures were posted for 2017 or any of the years prior to 2015. When notified of the lack of disclosures for these years, Rec and Park staff posted a Form 802 disclosing tickets distributed in 2017 and said they would look for disclosures from 2009 to 2014.[54]

The free festival tickets constitute a substantial personal benefit to the City employees and officers who receive them. In 2019, the retail prices for festival tickets were $155 for a regular one-day pass, $355 for a VIP one-day pass, and $785 for a VIP three-day pass. As mentioned above, Rec and Park has reported distributing $430,950 in Outside Lands tickets over the five years for which reporting was made available. Most of these tickets go to individuals within Rec and Park. According to Rec and Park staff, the free festival tickets are given to employees as a reward for performance. This is done through a raffle and various award processes. It is not clear which employees within the department have received tickets in the past. The department does not disclose the names of the employees on the Form 802, and department staff were unable to provide this information when it was requested.

As in the case of DPW and the other departments discussed above, Rec and Park’s practices regarding free Outside Lands tickets are problematic. The department regularly distributes personal benefits to department officers and employees that are obtained from a company that is a restricted source for those individuals. Department officials are prohibited from accepting gifts from Another Planet because of the company’s business before the department, a restriction that is designed to limit the potential for pay-to-play and avoid the appearance of preferential treatment. Acting as an intermediary for a high volume of such gifts gravely undermines the restricted source rule.

The fact that the free tickets are presented as a requirement in a permit agreement, as they are in the Outside Lands permit agreement, does not serve to mitigate the corruption risk inherent in restricted source gifts. The free tickets are not a form of payment that accrues to the City in exchange for the use of the premises. Rather, free tickets allow City officials to attend the event and to enjoy the festival as attendees. If anything, requiring free tickets that are provided for the personal use of City officials in a City contract only reinforces the tickets and the benefits they provide are a cost of doing business for City contractors. This practice can create a culture of expectation that is the basis of a pay-to-play system: entities doing business with the department may come to believe, rightly or wrongly, that gifts are helpful or even necessary in order to secure favorable outcomes from the City.

Likewise, the fact that a department decides which officials are allowed to enjoy free tickets does not significantly mitigate the corruption risks either. For one, the officials receiving such gifts typically know that they were provided for free by the event promoter and not paid for by the department. The potential that an official will look favorably on the restricted source donor is not removed because the ticket is handed to them by another department official rather than a representative of the restricted source; the true source of the gift is obvious. Similarly, the restricted source knows that a free event ticket given to a department will have a personal benefit for the officials who ultimately receive the tickets. Particularly when departments routinely distribute tickets to many high level officials, such as elected officers, commissioners, and directors, this practice makes it likely that a restricted source may seek to influence officials by giving free event tickets to the department.

This practice by Rec and Park has been ongoing for several years and even extends back to when the department had authority over Candlestick Park and received free tickets to 49ers games. When asked by a reporter in 2012 about the practice of receiving free 49ers tickets despite the fact that the 49ers contracted with Rec and Park, Mark Buell, who was then and is the current President of the Rec and Park Commission, said at the time that commissioners “serve at $97 a month and they put in a lot more time and effort than that.”[55] Anytime gifts from private sources are considered a form of compensation for City service, there is a danger of pay-to-play. This danger is greatly increased when the gift comes from a company doing business with the official’s department. Among other goals, the restricted source rule is intended to prevent gifts from being used by businesses to reward or incentivize favorable treatment from City officials. Practices that enable officials to receive free tickets from restricted sources undermine this important protection.

War Memorial Board of Trustees – Free Event Tickets from Tenant Organizations

The San Francisco War Memorial and Performing Arts Center (War Memorial) is a City department that administers multiple entertainment venues owned by the City, including the War Memorial Opera House and the Davies Symphony Hall. War Memorial is governed by the eleven members of the Board of Trustees, who are appointed by the Mayor.[56] War Memorial leases its venues to various performing arts presenters, including the San Francisco Symphony, San Francisco Ballet, and San Francisco Opera. These agreements are approved by the Board of Trustees. Because these lessees are parties to agreements with the department, they are restricted sources for officers and employees of the department, and the officers and employees are prohibited from accepting gifts from them.

However, War Memorial reports a large volume of free performance tickets that are provided by the venue lessees to the members of the Board of Trustees. War Memorial has reported distributing 3,392 tickets worth a total of $516,031 since 2012.[57] The majority of these tickets go to the Board of Trustees and War Memorial Staff. For example, in 2019 War Memorial trustees and staff received 337 tickets valued at $47,345 from the Symphony, Ballet, and Opera alone.[58] That year, 81% of all free tickets reported by War Memorial went to War Memorial officers and employees. War Memorial confirmed that City officials do not need event tickets in order to access the properties managed by the department when performing administrative functions; the tickets the department distributes are to allow the recipient to attend performances as a member of the audience.[59]

Like Rec and Park, War Memorial has embedded the flow of free tickets into their lease agreements with the lessees. For example, the most recent License Application and Agreement that War Memorial entered into with the San Francisco Opera Association requires the Opera to provide 10 tickets for each performance to the department for use by War Memorial trustees. The agreement further specifies the exact seats that must be provided for trustee use.[60] The department’s ticket distribution disclosures indicate that individual trustees are often given multiple tickets for a single performance, presumably for use by their guests.[61]

This practice by War Memorial is problematic in light of the restricted source rule. The rule prohibits trustees from accepting gifts from lessees, but trustees routinely receive expensive event tickets that the lessees provide for free to the department. The restricted source rule is intended to ensure that official decisions affecting those who do business with City departments are not compromised by personal benefits being provided to City officials. The free ticket practices observed on the part of War Memorial jeopardize this important policy objective and may undermine public confidence in the impartiality of trustee decisions affecting the lessees.

For example, at its December 10, 2015 meeting the Board of Trustees voted to approve a 30-year lease agreement with the San Francisco Opera Association for use of space in the Veteran’s Building.[62] The minutes from the meeting indicate that a trustee, who was acting chair of the Board’s Budget and Finance Committee, had led the Board of Trustees’ review of the lease agreement. The trustee moved to approve the lease agreement, which was approved 7-0. Five months later, the same trustee received two free tickets to the Opera’s May 28, 2016 performance, valued at $540. The trustee went on to receive four free Opera tickets in September of that year ($1,260), four in October ($1,120), six in November ($1,830), and two in December ($610).[63] Thus, within twelve months of the trustee’s action on the Opera’s 30-year lease, the trustee had received 18 free Opera tickets valued at $5,360. This example illustrates the factors that can give rise to an appearance of undue influence and pay-to-play when restricted sources provide free event tickets to City officials through a City department. These concerns are what the restricted source rule was created to prevent.

Scope of Free Tickets Gifted by City Departments

As a general matter, free tickets distributed to City officials by City departments represent a significant and under-scrutinized proportion of the total amount of gifts being reported as received by City officials. Table 3 presents the total number and value of tickets reportedly distributed by departments since 2009.

Table 3: Summary of Reported Ticket Distributions (2009-2021)

| Department | # of Form 802s Reviewed | # of Tickets | Value of Tickets | Percentage of Total Value |

|---|---|---|---|---|

| Recreation & Parks | 23 | 3,605 | $643,569 | 49.99% |

| War Memorial | 80 | 3,392 | $516,031 | 40.09% |

| TIDA | 16 | 607 | $92,012 | 7.15% |

| Arts Commission | 12 | 413 | $30,975 | 2.41% |

| Film Commission | 4 | 63 | $2,504 | 0.19% |

| Port Commission | 4 | 6 | $1,725 | 0.13% |

| Fine Arts Museums | 1 | 14 | $490 | 0.04% |

| Asian Art Museum | 0 | 0 | $0 | 0.00% |

| Total | 140 | 8,100 | $1,287,306 | 100.00% |

The available Form 802s for the eight City departments with ticket policies report that 8,100 tickets worth $1,287,306 were distributed by those departments for the period 2009-2021. More than 90% of the reported value of tickets distributed by departments comes from just two departments: Rec and Park and War Memorial. Combined, these two departments have distributed tickets with a value of more than $1.1 million since 2011.

This flow of personal benefits to City officers and employees is significant. Free tickets that are given to a City official by a department are not required to be reported on the official’s Form 700 Statement of Economic Interests under state law. When compared to the total value of all gifts reported by all Form 700 e-filers in the City (roughly 450 elected and appointed officers and department heads in total), the value of tickets distributed by City departments often surpassed the total value of all gifts reported by those filers, as seen in Figure 3. In years for which e-filed Form 700 data is available (2013-2020), the total value of reported gifts was $899,991 and during those same years the value of tickets distributed by departments was $1,127,824.

Figure 3: Total Reported Value of Free Tickets Distributed (Form 802) vs. Total Reported Value of Gifts Received by Electronic Filers (Form 700) (2013 – 2020)

Free tickets distributed through departments constitute a parallel universe of gifts that are not subject to traditional reporting and, in practice, are not constrained by the restricted source rule. Ninety percent of this large portion of personal benefits is distributed through two departments that require companies with whom they contract to provide the tickets for free. The departments then distribute many of the free tickets to officials for whom the companies are a restricted source. The nature of this practice, when viewed in light of the number and value of tickets being distributed, indicates a major issue compromising the City’s ethics standards and their effectiveness in practice. Section III will address this issue by recommending policies to end the underlying practices.

2. Review of Effectiveness of Public Disclosures of Gifts to City Departments

The previous subsection discussed problematic departmental gift practices that undermine the restricted source rule and create the danger and appearance of pay-to-play. New, strengthened policies should be enacted to end those practices, and ways to achieve that goal will be discussed below in Section III. This subsection discusses gifts to departments more broadly, focusing on how effective the existing disclosure requirements are at creating transparency. Transparency into each gift to a City department is critical, regardless of whether the gift is given by a restricted source. Transparency allows the public and City accountability departments like the Ethics Commission to track patterns in gifts and identify gifts that may give rise to ethical concerns.

This section presents information about each of the disclosure requirements (website disclosure, annual report to the Board of Supervisors, disclosure to the Controller, accept-and-expend approval, and ticket distribution disclosure) and discusses observed problems that limit each disclosure’s effectiveness.

Department Website Gift Disclosures

As explained above, the Sunshine Ordinance requires each department to post information on its website about each payment received from an outside source for the purpose of carrying out a City function. Staff sought to locate and review the Sunshine Ordinance gift disclosures of each of the City’s 60 departments[64] and assess how accessible and complete the disclosures are. If effective, the public should be able to easily gain an understanding of what outside funding sources are giving to the city, how much these sources are giving, and if the contributor has any financial interest involving the City.

For 23 of the 60 City departments (38%), gift disclosures can be found on the department’s website.[65] For 7 departments (11%) the disclosures could be found with a minimal amount of searching the department’s website. For 16 departments (27%) the disclosures could only be found with intensive searching or assistance from department staff.[66] For 37 of the 60 departments reviewed (62%), no gift disclosure page was found. For these departments, it is possible that no gifts were in fact received, a previous disclosure page existed but has been taken down, the department has failed to disclose gifts that were received, or a disclosure page exists but is not made readily available.

Aside from searching the websites of these departments, Staff also communicated directly with several of the departments to get a better understanding of how they currently comply with this disclosure mandated by the Sunshine Ordinance. Several departments asked for guidance about the disclosure requirement after being contacted, and four departments created gift disclosure pages where none had previously existed.[67]

Through the process of searching for and reviewing the available Sunshine Ordinance website disclosures, Staff identified several issues that undercut the effectiveness of this disclosure and make compliance more difficult for departments.

Decentralization: Current City law requires departments to post gift disclosures on their individual websites, which inherently leads to a decentralized set of disclosures. If a member of the public wanted to know how much a specific entity or individual had given to various departments across the City, they would need to search the website of every City department.

Lack of Standardization and Uniformity of Disclosures: The Sunshine Ordinance fails to specify how departments are supposed to meet this disclosure requirement, which leads to a lack of uniformity across different departments’ disclosures. This lack of standardization and uniformity can be observed in several aspects of the disclosures, including:

- Accessibility and Usability: The Sunshine Ordinance does not specify where on a department’s website its gift disclosure must appear or how it must be labeled. This lack of specificity leads to departments placing their disclosure pages on different parts of their websites and to labeling the pages differently.

- Timing: It is not clear how quickly a gift must be disclosed after it is received by a department. It is also not clear how long a gift must remain posted to the department’s website after it is first published. Some departments have gift disclosures that go back more than 15 years, while others have records that do not go nearly as far back.[68]

- Form and Structure: There is currently no set, Citywide structure for this disclosure requirement. This means that each department needs to determine their own way of structuring and presenting their gift disclosures. Staff observed multiple disclosure structures across various departments. Additionally, some departments embed their disclosures directly on their websites, whereas others provide PDFs or Excel files that must be downloaded. This lack of a consistent structure further makes it difficult for members of the public to compare and combine gift data across departments.

- Determining Financial Interest: The Sunshine Ordinance requires that each disclosure include “a statement as to any financial interest the contributor has involving the City.”[69] This requirement is presumably designed to highlight any favorable outcomes that the donor may possibly be seeking by making the gift. However, current law fails to define financial interest in this context or specify how to produce this statement. This leaves departments with the responsibility of determining their own methods for identifying financial interests. For example, some departments have developed their own unique forms to collect this information from donors. On the SFO Museum’s disclosures, many of their records state “no response given” in the financial interest disclosure field.[70] Other departments do not even include space for financial interests on their disclosure pages.[71]

Disclosures Often Incomplete: Staff also observed multiple instances of gift disclosures simply being incomplete. Multiple departments identify donors as “anonymous,” instead of fully disclosing the names of all donors as required by current law.[72] Other disclosures fail to include the value of the gifts being given. For example, in the FY 2020 disclosure from the Department of Public Health, 46% of the gifts disclosed were valued at zero dollars.[73]

For the above reasons, the disclosures currently required by the Sunshine Ordinance are decentralized, are produced using inconsistent processes, create confusion among City staff, and fail to provide a transparency for the public into outside sources of funding for City departments. As will be discussed in Section III below, a strengthened, centralized disclosure mechanism is needed to address these issues.

Annual Reporting to the Board of Supervisors

As explained above, the Administrative Code requires departments to submit a report each year to the Board of Supervisors disclosing gifts received. Staff searched for these reports on the Board of Supervisors website and worked with the Clerk of the Board’s staff to determine the complete list of annual gift reports submitted for FY 2019 and FY 2020.[74] Through collecting and reviewing the available annual gift reports, Staff observed multiple issues with this disclosure that potentially undercut its effectiveness.

Unclear when Reporting is Required: Reports showed multiple instances of departments only including gifts valued at less than $10,000, likely due to an assumption by departments that this report only needs to include items that have not gone through the accept-and-expend process. Also, although the City Attorney’s office has clarified that reporting should be done based on fiscal year, the Administrative Code as written fails to specify the reporting period, and at least one department reports based on calendar years.[75] Both examples indicate a potential lack of clarity among departments about what should be included in this annual report.

Poor Format and Accessibility: The reports submitted to the Board of Supervisors come in a variety of different formats, which makes combining or comparing them difficult. The Office of the Controller does provide a template format for how to present gifts in this report, but it is not universally used.[76] There is also no easily accessible, centralized location for reviewing these reports. To find them, a member of the public would need to search the Board of Supervisor’s website, find an often-lengthy PDF of bundled communications to the Board, and then find the copies of the communication between the department and the Board.

For these reasons, the current requirement for departments to disclose gifts via an annual report to the Board of Supervisors is ineffective and does not produce easily accessible data that the public can use to gain knowledge of outside sources funding City activities.

Disclosure to the Controller’s Office

The Administrative Code requires all outside funding and gifts received by departments “be promptly reported to the Controller.”[77] According to the Controller’s office, to satisfy the disclosure requirement, departments notify the Controller’s office via email when they receive gifts. However, the Controller’s office was not initially able to provide copies or summaries of these notifications or data about gifts that have been reported to the Controller’s office. The Controller’s office later indicated that some information about the notices may exist in the City’s internal Reports & Analytics dashboards, a system that is only available to certain City officials. The disclosures to the Controller’s office are not made available to the public online.

Given the lack of publicly available information about what departments have disclosed to the Controller pursuant to this disclosure requirement, it is clear that this Administrative Code disclosure requirement is not presently generating public information to promote public transparency into gifts to City departments.

Accept-and-Expend Records

As described above, departments must obtain approval by the Board of Supervisors to accept gifts valued at $10,000 or more, which is known as the accept-and-expend process. During FY 2019 and FY 2020, a total of 26 accept-and-expend resolutions were introduced at the Board. These approval requests were submitted from 11 different departments.[78] All but one of the accept-and-expend requests were approved unanimously by the Board of Supervisors.

The accept-and-expend process is intended primarily to serve as a check on departments’ acceptance of non-City funds; it was not designed or implemented as a public disclosure mechanism. Unsurprisingly, its effectiveness as a mechanism of public transparency into gifts to City departments is limited.

Records Not Easily Accessible: Finding these records first requires awareness of the accept-and-expend process, which may not be widely known. A member of the public interested in these records would then need to search for the term “accept and expend,” a term of art that is not even used in the administrative code. The Board of Supervisors does not compile or present these records in any singular spot for easy public consumption.

Many Gifts Approved Retroactively: Staff found that 18 of the 26 records (69%) reviewed were approved retroactively. The delay caused by this practice may prevents the public from having timely insight into gifts being received by departments.

Because of these shortcomings, and the fact that the accept and expend requirement was not designed to be a public disclosure, this requirement does not help to address the problems identified with the other gift disclosures discussed above.

Disclosure of Tickets Distributed by Departments (Form 802)

As discussed above, City officers and employees may receive free tickets from their City department without being subject to state gift laws if (a) the distribution is done in accordance with the department’s ticket policy, and (b) the distribution is reported on the department’s website by posting the Form 802. Because these tickets are typically received by the department in question for free and confer a personal benefit on the officials who receive them, it is important to consider tickets to be gifts for purposes of San Francisco gift laws, including the restricted source rule.[79]

For this reason, this report presented the total number and value of tickets reported on all Form 802s posted by the eight departments known to have ticket policies in Table 3 in Section II.B.1 above.[80] However, the Form 802 on its own does not provide an adequate view into gifts to departments: the form only captures a specific type of gift given through a department (tickets), and it is disclosed in a decentralized matter, which is not easily accessible to members of the public. The form is thus an additional part of the piecemeal disclosure approach regarding gifts to departments and does not solve the overall lack of transparency.

Disclosure of Gifts of Travel and for Official Agency Business (Form 801)

Gifts that are given through a government agency and used by agency officials for an official agency purpose do not constitute gifts under state law if the gifts are disclosed by the department on the Form 801. While several Form 801 filings were located on various department websites, they are infrequent and difficult to locate. Also, the FPPC only requires Form 801s to be posted to a department’s website if the aggregate value of reported payments surpasses a quarterly dollar threshold; if the dollar value is below the limit, the Form 801 only needs to be kept internally for public record. This means that even if all Form 801s posted on departmental websites were collected, it would not necessarily reflect all Form 801s produced by the department.

Clearly, the limited conditions which require the filing of the Form 801 and the decentralized nature of the disclosure makes this form an ineffective disclosure tool for San Franciscans interested in knowing what entities are contributing to City departments.

Comparison of Disclosures

There are three primary local disclosure requirements for gifts to departments which have been discussed above: (1) the department website disclosure pursuant to the Sunshine Ordinance, (2) the annual gifts report to the Board of Supervisors, and (3) the disclosure to the Controller. Additional transparency may be incidentally provided by the accept-and-expend process and state forms like the Form 801 (travel and official business gifts) and the Form 802 (tickets), but these tools are not intended to provide comprehensive disclosure of all gifts to a City department.

As discussed above, each of the disclosure mechanisms is ineffective on its own. And, even when the information contained in all of the disclosures is aggregated, the disclosures still fail to provide a complete and consistent view into gifts received by City departments. Staff gathered the available disclosures from the three public disclosures as well as accept-and-expend records for FY 2019 and FY 2020 and compared them in order to assemble the most complete picture available of gifts to City departments. In theory, there should be consistency between the three existing local disclosures; all gifts, regardless of value should be disclosed to the Board and the Controller and all gifts valued at more than $100 should be disclosed on the department’s website. All gifts worth more than $10,000 should also appear in the Board’s accept-and-expend records unless the gift was accepted through a statutory gift fund.

However, when these various disclosures are compared, there exist discrepancies among 70% of the departments reviewed. There were a total of 23 City departments that disclosed a gift via at least one of the three disclosures mechanisms or obtained accept-and-expend approval in FY 2019 or FY 2020. Of these 23, Staff observed reporting discrepancies among 16 of the departments. Only five of the 23 departments appeared to clearly meet all disclosure requirements. For example, some departments omit from their reports to the Board all gifts valued at more than $10,000, labeling their annual reports as being “on Gifts Received Up to $10,000.” This is despite the guidance of the City Attorney’s Office that annual reports must cover “any gifts received by the department in the previous fiscal year, regardless of amount.”[81] Additionally, multiple departments reported gifts via annual Board gift reports or accept-and-expend requests that did not appear on their website disclosures. Departments also appear to be confused as to whether grants received by departments need to be included within the website disclosures. It is thus not possible to piece together the multiple ineffective disclosures to create a comprehensive picture of gifts to City departments.

The primary shortcomings of the various disclosures are summarized in Table 4 below.

Table 4: Summary of Shortcomings in Disclosures of Gifts to City Departments

| San Francisco Law | State Law | |||

|---|---|---|---|---|

| Website Disclosure | Controller Disclosure | Annual Report to Board of Supervisors | Accept-and-Expend Approval | Forms 801 and 802 |

| Action: Gift must be disclosed on department’s website. | Action: Gift must be disclosed to the Controller. | Action: Gift must be included in an annual report to the Board of Supervisors. | Action: Gifts over $10k must be approved by the Board of Supervisors. | Action: Certain gifts must be disclosed on FPPC forms |

Problems:

|

Problems:

|

Problems:

|

Problems:

|

Problems:

|

The current local disclosures for gifts to departments are ineffective, redundant, and present compliance challenges for departments. A side-by-side comparison of the disclosures made by departments appears to indicate that compliance with the requirements is problematic. But, even if compliance were 100%, this data would still be piecemeal and decentralized and would still fail to offer the public a sufficiently transparent view into the people and entities that provide gifts to City government. Section III will recommend that a single, standardized disclosure administered by the Ethics Commission be created to provide more effective transparency to the public.

III. Findings & Recommendations regarding Gifts to Departments

This report has documented multiple issues with the receipt and distribution of gifts by City departments. In particular, there is a documented trend of City departments distributing gifts from restricted sources to City officers and employees. Additionally, the public disclosure of gifts to departments is ineffective. Each of these problems creates the opportunity for gifts to City departments to unduly influence the official actions of officials within those departments. It is critical that these issues be addressed so that the public can trust in the fair and unbiased operation of City departments. The most problematic practices should be more clearly prohibited, and more effective transparency should be instituted for all gifts. This section presents findings and recommendations to achieve these goals.

A. Findings and Recommendations

1. When depts distribute gifts provided by a restricted source to city officials that confer a personal benefit on those officials, this practice undermines the restricted source rule and must be more clearly prohibited.

Findings: As discussed above, a central allegation in the federal corruption probe into San Francisco’s City government was that two Recology executives provided funding to the Department of Public Works for the department’s holiday parties and other perks. The Department of Justice alleges that the executives intended to influence official actions, which constitutes bribery under federal law. But this practice, even absent the intent to influence, contradicts the intent behind San Francisco’s restricted source rule. Because of its contracts with DPW, Recology was a restricted source for all DPW officers and employees, and these officials were therefore prohibited from accepting any gifts from Recology. However, many DPW officials received free food, drinks, entertainment, and other personal benefits paid for by Recology solely because they were provided as gifts to the department and not directed by Recology to any single individual. Because these gifts were actually paid for by a restricted source, they raise, at a minimum, a serious danger of the appearance of pay-to-play corruption and run counter to the purpose of the restricted source rule.