December 4, 2023

To: Members of the Ethics Commission

From: Patrick Ford, Director of Enforcement

Subject: Agenda Item 11: Quarterly Enforcement Report

Summary and Action Requested

This report provides general programmatic updates and data about the cases handled by the Commission’s Enforcement Division.

No action is required by the Commission, as this item is for informational purposes only.

Cases Resolved

Fiscal Year 2024

So far in Fiscal Year 2024 (July 1, 2023 – November 27, 2023), the Enforcement Division has concluded a total of 35 enforcement matters. Three of these matters resulted in stipulated settlements approved by the Commission. In total, these settlements represented penalties of $51,525.

Cases In Progress

So far in FY24, 47 enforcement matters have been initiated. The majority of these (31) began from complaints that the Commission received from the public, but this also includes 16 matters that the Division initiated based on media reports, observations in public disclosures, independent research, findings from audit reports, and interactions with regulated persons. Four matters were initiated based on a referral from the Controller’s Whistleblower Program. Most of the matters initiated in FY24 remain in progress while 18 have already been resolved.

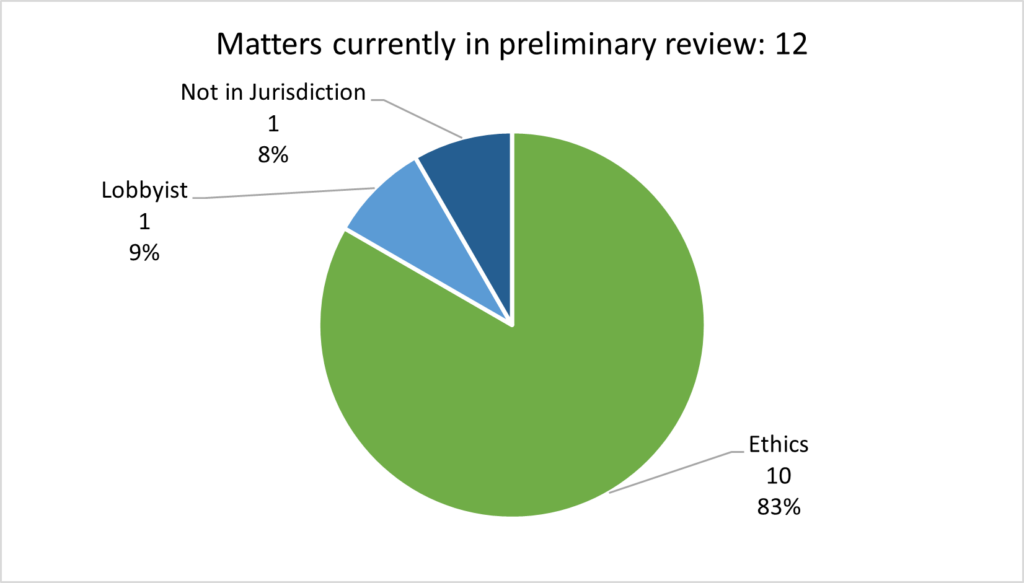

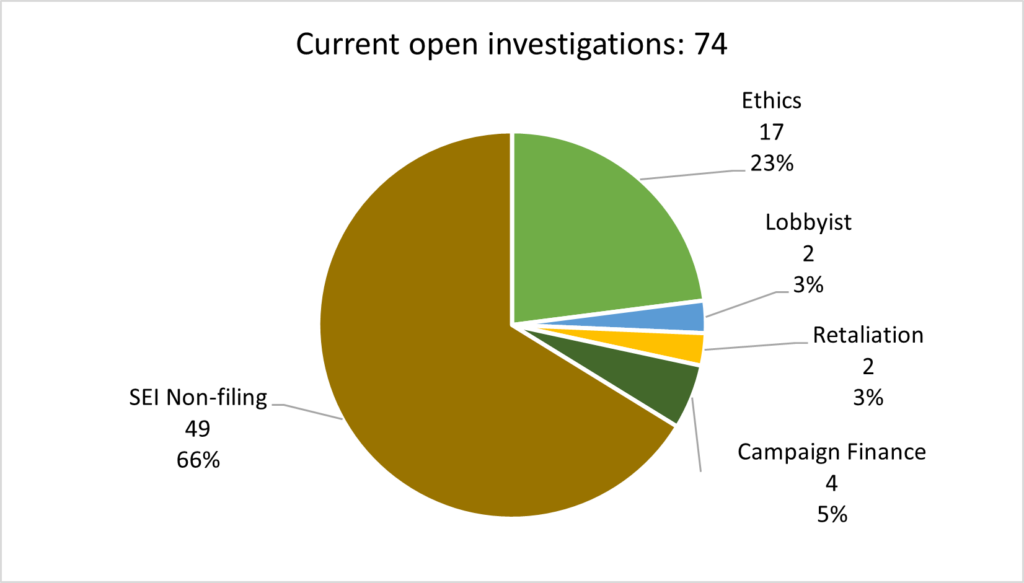

In total, 86 matters are currently in progress, including matters that were initiated during FY24 and matters that were initiated in prior fiscal years. Of these matters, 12 are in preliminary review, and 74 are open investigations. Forty-nine of the investigations pertain to individuals who failed to file the Form 700 in calendar year 2023. These matters were initiated this quarter as part of the Enforcement Division’s new protocol for addressing Form 700 noncompliance, as discussed in greater detail below.

The current cases in progress are broken down by program area in Charts 1 and 2 below.

Chart 1 – Matters in Preliminary Review by Program Area

Chart 2 – Open Investigations by Program Area

Form 700 Noncompliance Protocols

As discussed in the October enforcement report, one of the Division’s ongoing initiatives for FY24 is to institute a new standard protocol to address instances when individuals fail to file the Form 700 or file the form late. Universal electronic filing of the Form 700 became operational on January 1, 2022. Under this new requirement, all City officers and employees who are required to file the Form 700 must do so electronically through the Commission’s NetFile system. Prior to 2022, only City officers filed electronically, while employees filed in paper form with their departments. In addition to making disclosures more readily available to the public, universal e-filing also makes it possible to track filer compliance in real time. This new capability enables new approaches both to compliance work and to enforcement.

Another development that necessitated a new protocol for late and missing Form 700s is the loss of the Enforcement Division’s Fines Collections Officer position. Prior to the retirement of the last Fines Collections Officer, this position was responsible for identifying and issuing late fines to individuals who filed forms past the deadline, including Form 700s and campaign finance filings. After the retirement of the last incumbent, the vacant position was slated to be repurposed to support other critical department-wide operations but has not been filled due to budget constraints. The Enforcement Division’s new Form 700 late fines protocols have adapted to the loss of this position by streamlining the late fines process. This primarily involves imposing late fines only in a narrower set of circumstances that, pursuant to a set of objective criteria, are deemed more severe. The criteria include number of days late, disclosure category, and history of late or missing filings. A similar approach is being used for filers that have failed to file the Form 700 altogether.

The Enforcement Division’s new protocols for addressing late filings and failures to file use each filer’s current filing status information in NetFile to identify which of the City’s 5,297 filers have failed to file the Form 700 or have done so late. At this time, 5,071 filers (95.7%) have filed the Form 700 that was due in 2023. Of these, 236 (4.5%) filed late. Currently, 226 filers (4.3%) failed to file an Annual Form 700 due in 2023. The Enforcement Division used an objective set of criteria to select 49 non-filers to be pursued through enforcement action. The criteria were the filer’s disclosure category, position (with managers being prioritized), history of non-filing, and department (with departments with higher rates of non-compliance being prioritized). Because of the staffing resources required to carry out each case, the Division limited the cases to 49 out of 218 non-filers (22%). Each case will be administered through the Streamlined Administrative Resolution Program (SARP) unless evidence indicates that the case is ineligible for SARP. This could happen if large financial interests were required to be disclosed on the missing Form 700 or if a conflict of interest or incompatible activity is discovered.